Preface

1. We assume you have a business banking account for your business.

2. We all know how to use personal online banking to pay our income taxes to CRA.

§ In case you don’t know, you could add CRA as the payee and use your SIN as the account number.

3. If you are self-employed and you will need to pay GST to CRA, the personal bank account may not help.

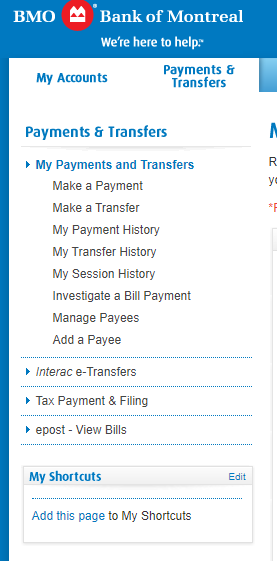

4. your bank’s interface with Tax Filing Service may vary.

5. There could be “sub-types” when selecting RC/RT payment types:

§ Payment on filing: with this option, you can actually file your RC/HST returns, followed by the payment.

§ Interim: use this option when you make an instalment (monthly, quarterly) payment.

§ Amount owing: use this option when you have received a Notice of Assessment or Notice of Reassessment indicating you owe CRA money.

§ Balance due: use this option when your payment is due prior to filing a return.

Here is the screen shot from BMO